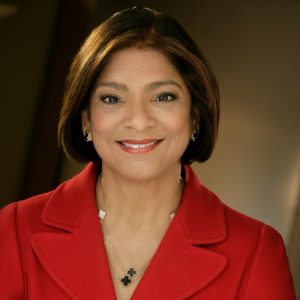

Subha Barry is a C-suite leader and an advisor who brings a unique perspective on the alignment of corporate culture to talent strategy and business results. As a transformational change agent, she has a proven record of identifying and accelerating new business creation, driving sales, and increasing profitability.

Subha is president of Seramount where she drives the firm’s vision, strategy, and business development. Subha joined Working Mother Media (WMM) in 2015 and during her tenure she dramatically improved margins, expanded its portfolio through growth in high-value consulting and learning and development, exponentially grew their client roster, and recruited talented executive leaders to amplify subject matter and functional expertise. In 2021, Subha oversaw the brand’s transformation from WMM to Seramount, a leading strategic professional services and research firm dedicated to building high-performing, inclusive workplaces. Today, Seramount works with 450+ organizations globally, including half of the Fortune 500, to help our partners navigate today’s talent and DEI landscape.

Previously, Subha was senior vice president and chief diversity officer at Freddie Mac, where she served on the firm’s management committee and led their foundation. Prior to her time at Freddie Mac, Subha spent 20+ years at Merrill Lynch as managing director and their first global head of diversity & inclusion where she built their D&I strategy, infrastructure and execution plans from the ground up. She also created a highly successful Multicultural Business Development Group to focus their wealth management business on diverse and multicultural communities bringing in over $8 billion in new assets and $50+ million in annual revenues in just three years. She began her career at the firm as a financial advisor where she was a top 100 advisor among 16,000 in the firm.

Subha is a former adjunct professor at Columbia University’s SIPA, and currently serves on the Boards of SHRM Foundation, Rice 360, Rutgers Cancer Center and the Rutgers Institute of Women’s Leadership. She is also a Board Advisor at PE-owned Snowden Lane Partners. In the past, Subha has served on a variety of Boards as Board Chair, Head of Nominating & Governance, Finance, and HR and DEI Committees.

A native of India, Subha holds a BA from Bombay University and an MBA and MS in Accounting from Rice University. She enjoys golfing, reading poetry and rallying for social change. She has two grown children and lives in Naples, Florida and New Hope, PA with her husband.